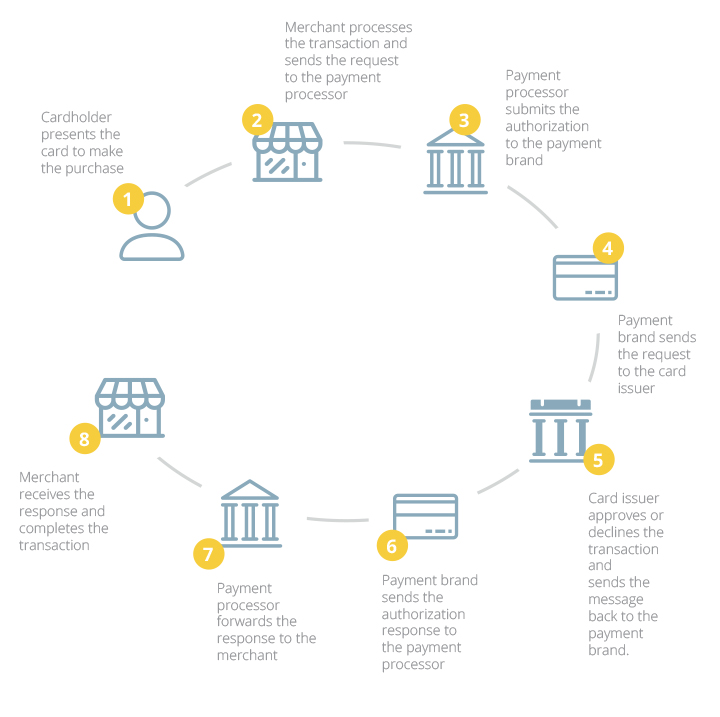

Ever wonder what goes on behind the scenes during a transaction? Authorization is the process of approving or declining a transaction before a purchase can be completed. When consumers purchase something, the card is swiped, inserted, or entered (in the case of eCommerce), and the transaction is either approved or declined immediately. But on the back end, it is far more complex:

1. The cardholder gives the merchant their credit card for payment. The merchant terminal reads the card information encoded on the magnetic strip or chip.

2. The merchant terminal then passes the information and transaction amount to the payment processor.

3. The payment processor encrypts the information into an authorization request and sends it to the payment brand.

4. The payment brand then routes the authorization request to the issuing bank for review.

5. The issuing bank will approve or decline the transaction by verifying whether the card is legitimate, is reported lost or stolen, and has enough funds available in the account. The issuing bank then creates an authorization message and sends the information back to the payment brand.

6. The payment brand, in turn, sends the authorization response back to the processor.

7. The processor transmits the information to the merchant terminal.

8. The merchant concludes the sale with the customer.

And it all happens within seconds.

For eCommerce, once the consumer enters their card information for payment, the processor passes the information onto the payment brand through a secure gateway.

This is an adapted excerpt from our eBook Payment Processing 101: A Merchant’s Guide to All Things Payments. It’s your ultimate resource for understanding how you get paid. Download your free copy on the right.