While not a new concept, there’s been a lot of chatter recently about bitcoin’s engine: the blockchain. But what exactly is blockchain technology and its potential?

First, what’s bitcoin?

Bitcoin is a form of cryptocurrency that relies on a peer-to-peer network to verify and record transactions. Bitcoins are created by solving complex mathematical formulas using decentralized servers in a process known as “mining”. One of bitcoin’s major attributes is that it’s a decentralized currency with no need for a governing authority – this is facilitated by the blockchain.

So what’s blockchain?

Blockchain acts as a guarantor of ownership, primarily of digital goods at the moment, but uses for tracking physical goods (such as diamonds) are being explored. At a basic level, the blockchain works as a public ledger that permanently records every bitcoin transaction. Think of the blockchain as being inked in permanent marker; you can write and add to it, but you cannot delete anything. There is no bookkeeper, if you will, that maintains the ledger; the technology of blockchain is self-regulating and allows bitcoin to exist without a central bank. Each bitcoin transaction in the blockchain is verified by the community using cryptography.

What is cryptography?

“Cryptography is the branch of mathematics that lets us create mathematical proofs that provide high levels of security. Online commerce and banking already use cryptography. In the case of Bitcoin, it’s used to make it impossible for anybody to spend funds from another user’s wallet or to corrupt the blockchain. It can also be used to encrypt a wallet so that it cannot be used without a password. No one can change your money or make a payment on your behalf.”

The verification process

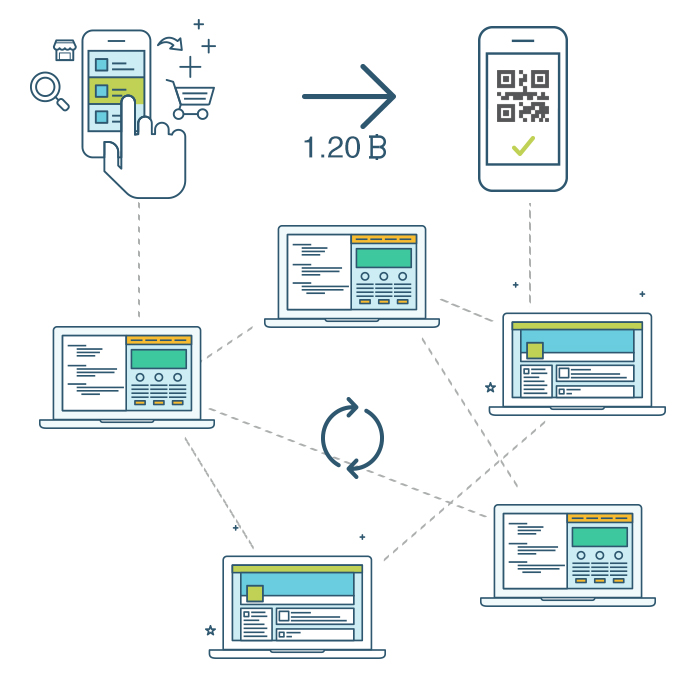

The blockchain is a collaborative effort; the code is open-source, so anyone who wants to participate can do so. When someone sends bitcoins, a message is created with the amount and destination represented in a “block”. The message is circulated to the network of thousands of computers (bitcoin “nodes”) around the world for confirmation of ownership. A unique signature is attached to each transaction to prove its authenticity. These signatures effectively prevent fake transactions and double-spending. Users (miners) verify whether the signature is authentic by decrypting it. If successfully decrypted, the signature was created by the actual account owner. The transactions are recorded in chronological order; once verified, the block is added to the “chain” (hence the name blockchain).

It’s a mathematical race…ready, set, go

With many users verifying transactions, how does the blockchain decide on how to update the ledger? Simple: there’s a vote. The nodes must agree with each other in order to make any changes to the ledger. Miners vote by trying to solve a puzzle; the first miner to finish wins and the ledger is changed accordingly. To keep up with the transactions that are constantly being generated, this process occurs repeatedly – about every 10 minutes. Besides using an inordinate amount of computers and electricity to “outvote” the majority (which is unlikely), there are no shortcuts to solving the puzzles. The transactions are dependent on each other in the blockchain; each block builds on the previous one. Miners can’t get a head start and solve puzzles in advance because they need the preceding solution.

Why do miners participate?

As an incentive, a small reward of bitcoins is created and given to the miner when they solve a transaction. To ensure a steady stream of income, people often join mining pools that work together to solve transactions and distribute rewards.

The potential of blockchain

Bitcoin is not without its critics; blockchain and its potential was often overshadowed by the illegal uses linked to the cryptocurrency. The initial receptions of financial institutions were understandably uneasy because bitcoin was often described as a way to circumvent traditional banking systems.

But for financial organizations, blockchain technology has the ability to cut fees for global transactions, speed settlement, reduce the risk of fraud, and create transparency. Santander estimated that blockchain technology could reduce banks’ infrastructure costs by between $15-20 billion a year by 2022.

Rather than view blockchain as a threat, traditional financial institutions have begun to direct their efforts into finding ways to utilize the technology. Several startups are working on developing ways the technology can be used in financial services. Among them is R3 CEV, a blockchain start-up, composed of 22 major banks (including Goldman Sachs, JP Morgan, and UBS), whose goal is to explore ways to apply blockchain technology to the finance system. Barclays has inked a deal with Swedish company Safello to do the same. Meanwhile, Citigroup is developing their own version of bitcoin, Citicoin.

Bitcoin and blockchain are leading the way for innovation and positive changes in key areas and prompting the exploration of the technology in other industries. Organizations are rapidly recognizing that the inherent secure structure and decentralizing quality of blockchain make it a perfect vehicle for other purposes, such as verification, communication, and many other applications beyond cryptocurrency, such as notary services or voting systems.

Companies, organizations, and even governments have started to delve into how to repurpose the technology:

- NASDAQ is using the technology to track shares traded by private companies.

- Honduras is utilizing blockchain as a secure and tamper-proof way to record land titles.

- The Isle of Man is testing the technology with a registry of cryptocurrency companies on the island.

- ADEPT is a joint venture by IBM and Samsung who are using blockchain technology to develop “a distributed network of devices – a decentralized Internet of Things”.

Barriers

Implementation of blockchain for other uses will gradually evolve. Right now, the hype and excitement around emerging uses for the technology is high but development is still in infancy stages, and adoption for new innovations will take time. The recognition of blockchain’s potential exists but so does the reality that it will likely be years before the full potential of these practical applications comes to fruition. There are doubts about scalability for the mass market, and the amount of energy (in computers and electricity) needed to support blockchain weighs heavily on the environment.

Society is organized around the belief that banks, governments, and other such authorities hold power and can be trusted. The decentralized blockchain technology is disrupting the status quo and shifting power structures. Mass acceptance, of bitcoin and blockchain technology, will not come overnight.

Conclusion

It’s not hard to see why there are devout champions of blockchain: a system relying on mathematics, rendering it immune to corruption has its appeal. To date, the blockchain’s most prolific use is associated with cryptocurrency, as the technology that underpins bitcoin; however, it is also instigating a discussion on innovation in other spaces. The relevance of blockchain is clearly evident by the growing support, research, and funding that is being put into channeling the technology for a plethora of different uses.