“I love chargebacks,” said no one ever.

If you’ve never experienced a chargeback you should consider yourself extremely lucky! If you have, you know first hand what a huge pain they can be to deal with and no doubt want to reduce them as much as possible.

If you haven’t experienced a chargeback you may not know what it is so let’s define it: when a customer disputes a transaction with their credit card company and the credit card company reverses the transaction.

As a merchant this can be pretty frustrating. But, while chargebacks can definitely be annoying, you just need to remember they were put in place for good reason; to protect the consumer.

Chargebacks happen whether you own a brick and mortar store or an eCommerce store but this post will focus on how to cut down chargebacks for those of you with an online store.

Things such as poor customer service, your business name not showing up on credit card statements and a poor refund policy are just a few of the reasons why online chargebacks happen.

Besides the loss of a sale, your business can be affected in a few other ways too. Let’s first take a look at how eCommerce chargebacks affect your business.

How Chargebacks Affect Your Business

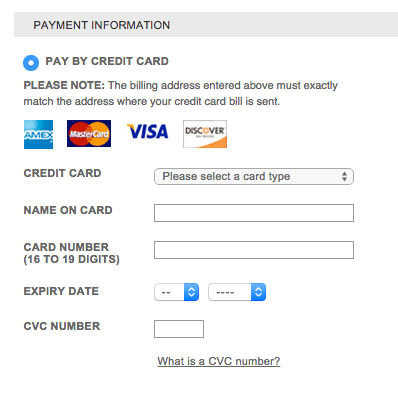

Credit cards used for online transactions are called “card-not-present” transactions meaning that the credit card information is manually typed in by a consumer. As seen below.

Unlike a transaction that would happen in a brick and mortar store, these transactions are considered more “risky” because the credit card is not physically present with the customer. Because of this risk, you the merchant are then 100% liable for any type of chargeback that happens, not the credit card company.

When a “card-not-present” chargeback occurs, it’s the merchant that suffers the loss of the transaction. Plus, your business is now subject to a chargeback fee that could potentially cost you up to a few hundred dollars.

If you’re experiencing chargebacks all the time you also run the risk of being labelled a “high-risk merchant” by the credit card institution.

This label can affect your ability to accept credit card payments in the future and can lead to major losses to your business or even worse, your account could be terminated altogether.

However, the good news is that you have the power to control the number of chargebacks you incur! Here are 3 ways that can help you prevent online chargebacks.

Merchant name on receipt

One of the biggest reasons why you could receive chargebacks is simply because your business name doesn’t show up on your customers monthly credit card statement.

Picture this. It’s the end of the month and your customer just got their statement. They’re going through it and start to recall all the names of the places they used their card, until they come across a $120.00 charge with a strange name “payment processor name xxx.” Suddenly they’re a bit panicky and start to think “did my card get stolen?”

Sounds sketchy and a little creepy right?

They call their bank and immediately reverse the transaction.

Yikes.

This is an actual scenario that happens to merchants all the time but could be easily fixed. To make sure this doesn’t happen to you, your company’s name must always show up on your customer’s credit card statement, not your payment processor!

This is something that with an aggregator, such as PayPal, you will have to enter manually otherwise PayPal will show up on your customer’s credit card statement and confuse the heck out of them.

However, many good payment processors make sure your business name always shows up on your customer’s credit card statement.

Another thing to keep in mind regardless of whether you’re currently signed up with an aggregator or possess your own merchant account is to never shorten or abbreviate your business name. For example, let’s say you own Bob’s Shoe Shop, when your customer looks at their monthly credit card statement they expect to see “Bob’s Shoe Shop” not something like BSS or Bob’s S.S.

Customer Service

The following list outlines the most popular means of customer service:

- Phone

- Live Chat

- Social Media

Given the multiple touch points a customer could contact a business, there is absolutely no reason why a customer shouldn’t be able to have a solution to their problem resolved or perhaps just a quick question answered in a timely manner.

With online orders, there are times many reasons why a customer needs to get a hold of you. Maybe shipping is taking too long or perhaps an order came broken; both these cases could be handled simply by being available.

If a question or problem goes unresolved due to the fact a customer can’t get a hold of you, they will have no problem calling up their credit card company and issuing a chargeback.

It’s extremely important for customers to know that you actually care about them. Customers are the backbone of your company, without them, your business wouldn’t exist.

Mark Cuban, Investor and all around ingenious business man, has been quoted as saying “Treat your customers like they own you. Because they do.” Always remember this.

By providing great customer service you’ll be a whole lot closer to preventing chargebacks.

Return Policy

Want chargebacks? How about angry customers slandering you on social media? If that sounds good to you, don’t offer returns.

I’ve said it before and I’ll say it again, you need to understand that chargebacks were put in place to protect the consumer and more often than not the chargeback is ruled in favor of them.

If a customer is unsatisfied with their purchase, wants a refund and you tell them no, they’re going to be angry, call their credit card company and issue a chargeback.

Instead of just the loss of a sale, you’ll be slapped with a chargeback fee and there will be a note on your account that a chargeback was issued.

However, if you simply cannot offer refunds for whatever reason, you’ve got to make sure your refund policy is very visible on your online store. You should be extremely clear as to what you’ll accept as a return and what you will not.

Stop the chargebacks!

Chargebacks, while incredibly frustrating, are easily avoidable. By applying some pretty basic principles you’ll be able to reduce or completely get rid of online chargebacks.

Your turn! Have you ever experienced a chargeback and if so how did you deal with it?