Subscription (or recurring) billing can be a blessing for a business. Hello, repeat customers! Subscription billing is when you routinely and automatically receive payments from a customer in exchange for a service or product.

This billing method increases cash flow by reducing delays between payment cycles and creates upselling and cross-selling opportunities in the form of upgrades and add-ons. Subscription billing is ideal for businesses because merchants can better predict long-term profits.

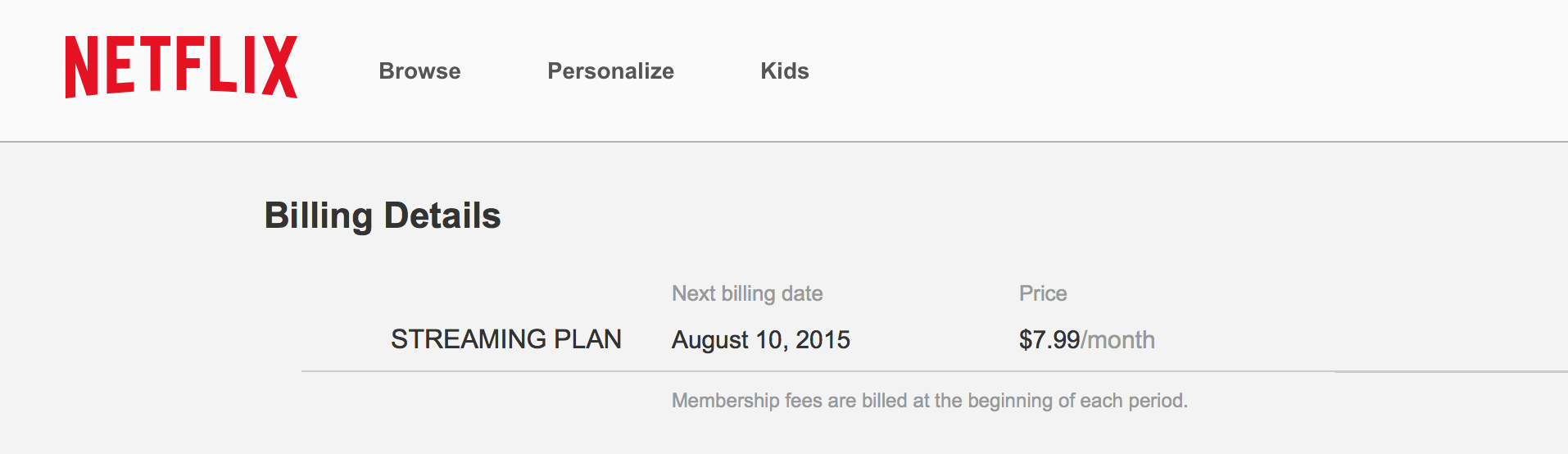

It benefits customers as well; they can set it and forget it. They don’t have to worry about remembering to pay bills on time. Monthly billing, in particular, is often a more digestible method for customers to pay. Subscription billing gained popularity a few years ago and nowadays this method is prevalent across all industries: movie and cable streaming (Netflix), Internet, exclusive membership plans, mobile phone, gym memberships, SaaS, etc.

However, nothing is perfect and there are some downfalls to subscription billing that merchants need to be aware of. If you don’t take the proper steps, you could face the dreaded chargeback from customers, which is detrimental to any business.

Chargebacks occur when a customer is unsatisfied with a service or product and goes directly to the credit card company to request their money back. The chargeback system was created to protect consumers; so naturally, the system often favors the customer. This means that you will incur fines and penalties from both banks and payment processors if your business is the recipient of chargebacks.

Chargebacks beget cancellations. Churn is not only the method to make rich, creamy ice cream, it’s also the rate of which your customers are opting out or cancelling their subscriptions. Recurring billing done right should reduce churn rate and prevent chargebacks. Here are 3 steps to ensure that.

1. Be explicit

Many subscription billing chargebacks occur because the customer does not fully understand all the terms of the agreement. It’s good practice to email them a rundown of the plan if discussed over the phone or in person. If they have signed up online, as many subscribers do, you need to explicitly outline everything that the plan entails.

The best way to prevent any confusion, and by extension chargebacks, is to lay out the terms of your RTA (recurring transaction agreement) with the customer as transparently as possible. If the customer understands every aspect of their agreement, they will be less likely to dispute and initiate a chargeback. Make sure that the customer understands vital information such as:

- Billing frequency (monthly, yearly, etc)

- The fixed payment amount

- Constant billing date

- Length of free trial or promotional periods

- Refund policy

- Cancellation policy

Your cancellation policy should be clear and easy to understand. The “cancel” button doesn’t have to be obnoxiously obvious, but it should be clear. When the cancelling process is stress-free, customers are more reassured.

It can be daunting for a customer to choose recurring billing when they can’t cancel if needed; you want to avoid customers thinking of you as a vacuum sucking money periodically with no end in sight.

Of course it’s discouraging when a customer cancels, but ultimately it is their prerogative. It’s not a good idea to lock customers into a contract. There’s nothing people love less than paying for something they don’t want.

When a customer does decide to cancel their subscription, you always want to end the relationship on a good note. Aim for: “I’m going to recommend you to others” rather than: “I’m going to write a scathing review online”. At some point in the future, the customer may decide to sign up again and the last thing you want to do is burn that bridge.

Lastly, get consent before you start billing customers. This may be obvious but it’s important — get a signature or a confirmation indicating they’ve read the terms. If you don’t obtain consent, you are setting your business up for chargebacks.

2. Be accessible and prompt

If customers have concerns or issues, ensure that they are able to contact you with ease. If they’re reaching out, chances are they’re not happy and quite possibly thinking of cancelling. However, this gives you the chance to show that your customer service is superb and a chance to retain the customer. And better they contact you than the bank for a chargeback.

In addition to being accessible, be prompt and efficient about replying to inquiries and resolving issues. The longer you let the process drag on, the longer the customer has to seethe in anger.

If a customer wants to cancel a subscription, take action immediately. A customer could initiate a chargeback if they continue to be charged after they’ve requested cancellation. Once you have successfully cancelled the subscription, send them an email confirmation. Which brings me to my next point…

3. Maintain communication

Be transparent in your communications. Keep in contact with your customers to notify them of:

- Changes to plans or pricing, such as trials or promotional periods ending

- Upcoming payments, especially if the last payment was some time ago

- Contract renewals, even if the renewal is automatic

- Promotions they are eligible for

It is always a good idea to send the invoice to the customer via email before charging the card.

My cell phone bill is charged on the 15th of every month. However, Rogers without fail sends me an invoice on the first, informing me that “x” amount will be charged. Not only do I appreciate the reminder, if the charge seems out of the norm, I can review the invoice to investigate why. If there is anything wrong, I can contact them about it before my card is actually charged.

Having consistent and open communication provides an opportunity for you to nurture your relationship with customers (social selling) and increase customer loyalty.

In the age of convenience, offering subscription billing is beneficial for both you and your customers. In general, preventing chargebacks is critical but for subscription billing, you need to pay attention to the specific pain points above. If you are upfront, accessible, and communicative, you’ll be well on your way to avoiding chargebacks from subscription billing.