This is an updated version of a post originally published in October 2014.

Unravelling the costs associated with accepting credit card payments can be a difficult feat. To help you understand what you pay to get paid, we’re going to look at a transaction breakdown and the different players who have a hand in processing your transactions. We’ll answer a few important questions like:

What determines the rate?

How much is taken for each transaction?

Where does the money go?

First, a few things…

As much as we hate to say it (because we know it’s not what you want to hear), the cost for payment processing “depends”. The fees associated with accepting credit cards depends on your processing volumes, card types, type of retailer, and type of transaction.

- Processing volumes: This determines which type of processor best suits your business. The higher you process, the more you’ll save with tailored fees.

- Card types: There are thousands of different credit cards – and each of them has a different interchange rate (the wholesale “cost” of a credit card). A basic no-rewards, no-points credit card will cost less to accept than a corporate, rewards card.

- Type of retailer: Some industries and businesses are considered higher risk, which correlates to a higher rate.

- Type of transaction: Whether you swipe your customer’s card through a traditional terminal in your brick-and-mortar store or you process an online payment will affect your rate. The same goes for when you key in a phone or mail order versus processing the card in-person manually. Card not present transactions have a higher rate because of the increased inherent risk.

The costs associated with getting paid are not “one size fits all”.

A transaction breakdown

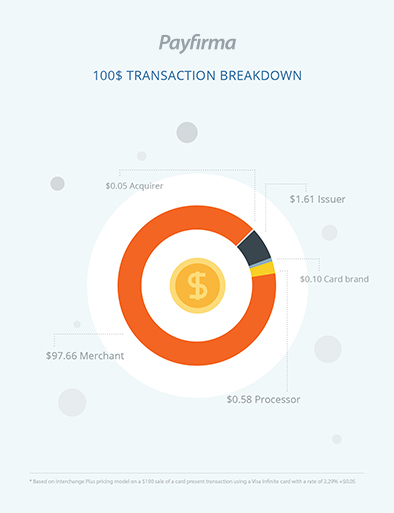

We created a visual breakdown of who gets which fee when you make a sale. The below depicts a hypothetical card present transaction of $100 using an interchange plus model, with a Visa Infinite card at a rate of 2.29% + $0.05.

| FEE | PERCENTAGE | $ GOES TO EACH PARTY |

| Interchange | 1.61% | $1.61 goes to issuer |

| Payment processor markup | 0.58% | $0.58 goes to payment processor |

| Card brand fee | 0.10% | $0.10 goes to card brand |

| Transaction fee | $0.05 | $0.05 goes to acquirer |

>> Remaining total that goes to the merchant: $97.66. <<

$1.61 goes to the issuer

This is known as the interchange fee. It goes to the issuer, a financial institution that issues the credit cards to consumers on behalf of card brands, sends credit card statements, and offers credit. These are the bank brands that you would see on credit cards, such as an RBC Visa.

$0.58 goes to the payment processor

A portion of your fees goes to the payment processor. These are the companies that partner with acquirers to maintain the merchant account, handle support, manage payment processing, and build added-value technology on behalf of acquirers. They can be financial institutions (TD Merchant Services), ISOs (Payfirma), or acquirers.

$0.10 goes to the card brand

This is the card brand fee that is paid to the card brand. They are more commonly known as credit and debit card companies, such as Visa, MasterCard, etc. Card brands govern the policies pertaining to their bank cards, monitor processing activity, and oversee the clearing and settlement of transactions.

$0.05 goes to the acquirer

This is a dollar amount that is added to each transaction known as the transaction fee. It goes to the acquirer, who solicits, underwrites, and owns the merchant account. Acquirers pass credit card information on behalf of the merchant, to the card brands so that a transaction can be completed. They provide technology and hardware to process payments and may also double as payment processors themselves.

$97.66 goes to you, the merchant

Once the fees are taken from the transaction, the remaining amount is deposited into the merchant’s account within 1-2 business days, typically. Funding times can vary depending on the type of payment processor you decide to partner with: an aggregator or a merchant account provider.

WTF? (Why the fees?)

To illustrate why the different entities take a cut of each transaction, think of it this way: the card brands are the wholesalers. They don’t deal directly with consumers; they only deal with banks (issuers and acquirers). The card brands allow the issuer to issue co-branded credit cards to consumers and acquirers to acquire merchants to accept credit cards. In turn, some acquirers are able to process payments themselves, while other acquirers allow third-parties (payment processors) to use their services as well as further innovate payment technology to bring more value to merchants. Payment processors allow a way to accept credit cards from multiple brands, issuers, and networks in a single, efficient way. Each entity plays a role in processing transactions and takes a small fee for doing their part.

While accepting credit cards comes at a small cost, there are many compelling reasons to accept credit cards. It’s important to understand where your hard-earned dollar is going so you know the true overhead of your business. Understanding what you pay to get paid helps you understand whether you’re paying a fair rate or if you’re getting gouged.

This is an adapted excerpt from our newest eBook Pricing Demystified: The Merchant’s Guide to Payment Processing Fees. To learn more about how fees and pricing work when you accept credit cards, download your free copy on the right.

This is an adapted excerpt from our newest eBook Pricing Demystified: The Merchant’s Guide to Payment Processing Fees. To learn more about how fees and pricing work when you accept credit cards, download your free copy on the right.