“I love my payment processor and I’m super stoked on payments!”

Is that something you can say? If not, you should really ask yourself why?

Ok, so maybe you won’t be “stoked about payments” or learning the ins and outs of the payment industry but you should love your payment processor.

Your payment processor should not only be viewed as a growth partner but someone you can trust and rely on as you expand your business; not a thorn in your side. More often than not though, payment processors get a bad rap and justifiably so.

Poor/no customer service, holding of funds, large transaction fees, monthly fees, undisclosed termination fees and untruthful salesman are just a few of the reasons why merchants have come to despise their payment processor. No wonder people have come to think of “payment processor” as a dirty word.

Luckily though, all processors are not considered equal. The question remains though: what does an effective payment processor look like?

Well, we’ve put together a list of 7 traits a processor must display in order to be deemed highly effective. And by highly effective we mean they should be there to effectively help grow your business.

24/7 Customer Service

Most companies state they have exceptional customer service. Honestly though, have you ever seen any company, anywhere, state “we provide bad customer service”? Many processors claim great customer service but that couldn’t be further from the truth. However, do not become disheartened, some processors really do provide great customer service!

If a payment processor truly cares about their customers they will provide exceptional 24/7 customer service, but do not take their word for it. You’ll need to sprout your best Magnum P.I Stash and do a bit of investigating to see if they really are as great as they say they are.

Here’s two simple ways that will be sure to give you some good insights into a processors customer service:

- Hashtag their company name on social media to see if there are a ton of negative complaints

- Use Google and search for negative comments, threads or reviews

No company is perfect and realistically there is probably going to be a few negative reviews but that’s ok. What you should take into consideration is how the processor dealt with those negative reviews. This will speak volumes as to whether or not the company cares enough to answer their customers complaints.

Low Transaction fees

Transaction fees suck, there’s no eloquent way to put it. But, while you’ll never escape having to pay them, they really are the price of doing business, you do have the ability to choose a processor that has low transaction fees. Believe it or not there are many processors that don’t feel right about charging their customers an arm and a leg to process with them. However, you need to be cautious of the ones that claim low fees.

Many processors hide their transaction fees through “fine print” in an attempt to be deceitful. So, as with customer service, a bit of research needs to be done on your part. You can do the same research for transaction fees as you would for customer service.

Some processors even have customer forums that you should be able to access. Check those out and see what other customers have to say. In the long run you could end up saving hundreds or even thousands in fees.

Transparent About Fees

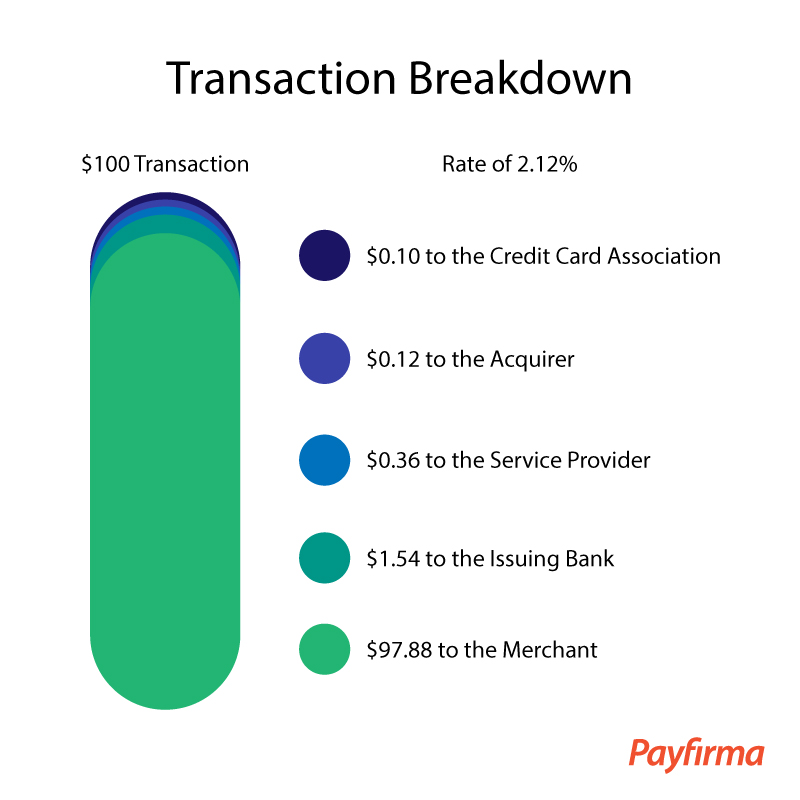

Transaction fees can be confusing and complicated. When a transaction occurs, whether in-store, online, or mobile, there are many different parties that get a piece of that transaction. The credit card company gets a piece, the payment processor get a piece, the issuing bank get a piece, the acquirer gets a piece and finally you, the merchant gets whats left of that transaction.

Here is a small diagram to help illustrate this breakdown of a $100 transaction.

Using this $100 transaction as an example, you the merchant have a right to know where the other $2.12 goes. A highly effective payment processor should be helping their customers understand those fees.

There are many more factors that can impact the cost of a transaction and if you don’t know what they are and want to know, your payment processor should be providing you with an answer.

Trustworthy

When you open a merchant account with your payment processor you should be happy and excited, not nervous and anxious.

Any strong relationship is built on trust, which can really only be gained over time, which is why picking a payment processor can sometimes make you feel the latter, nervous and anxious, but it doesn’t have to be that way. There are signs to look for that can help you determine whether or not the processor is truly trustworthy.

- Do they have strong relationships with established, trustworthy partners?

- Do they have current case studies of happy customers?

- Are they active on social media, engaging with their customers and trying to establish relationships?

- Do they provide valuable content for their merchants?

- Are there good reviews and positive comments from customers?

- Are they transparent about fees of any kind?

A payment processor that is trustworthy should have positive feedback about them which you should be able to find in many different places.

Reporting

Any business, big or small, needs to understand how to best run their business and your payment processor should be able to help with this. An effective payment processor should allow you to log in to a dashboard and see actual reports, so you can make better decisions for your business based off what you see.

Imagine being able to see which method of payment brings in the most money or at what time of the day you are the most profitable. Data like this can equip you to make more informed business decisions which in turn will have a positive impact on sales.

Constantly Improving Product

Is there anything worse than a company that doesn’t improve their product despite hundreds and hundreds of complaints? I’m sure you don’t think so either.

With the world of payments changing so rapidly, a processor needs to stay up to date in order to avoid complaints of being old and clunky, yet many still don’t change, which is absolutely crazy considering the following stats and information.

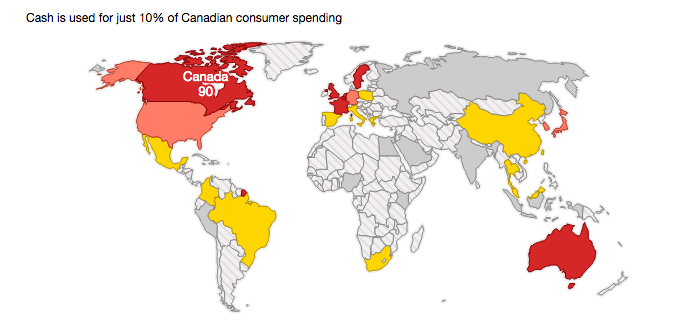

Consumers are fed up waiting in line and many would rather pay through mobile devices. Cash only joints are disappearing faster than hot cakes as only 10% of Canadian transactions are done through cash. Consumers want the ability to pay however they want, wherever they want.

That means that in order to stay relevant a payment processor needs to be constantly improving their product to stay up to date with industry standards and even look for ways to innovate.

See Payments In One Place

A highly effective payment processor will let you take in payments multiple different ways and see all your transactions in one place. For example a merchant that is taking in payments through mobile, eCommerce and a physical retail location, this is an absolutely necessary trait. Who wants to waste time logging into 3 different accounts?

Not only does this save time but it’s also extremely convenient and easy to track things like where payments are coming from and when your best sales times are.

Takeaway

There are many different processors out there for many different businesses, there is no “one size fits all” solution. However, these 7 traits should be possessed in order to be considered a highly effective payment processor.

Your turn! What is your favorite thing about your payment processor?