This is an updated version of a post originally published in September 2014.

The payments evolution

Monetary mediums were once rooted in physical forms like livestock, leather, and paper currency, but modern forms of payment have evolved considerably. Even payment forms like cash and cheques are decreasing in usage (cash volumes are expected to fall by 30% over the next 10 years), while electronic and digital payments (credit, debit, and mobile payments) are increasing in popularity.

The payment process is becoming more and more “invisible” and fluid. Omni-channel consumer behavior has created opportunities for value-added technologies to emerge, leading to a friction-free payment ecosystem between merchants and buyers. Increasingly, consumers are using their smartphones for basic transactions, companies are transforming everyday items into payment objects, and blockchain (the technology that underpins bitcoin) could change payment verification as we know it today.

From cash to cards to cryptocurrency, the payments evolution continues to unfold.

Ecosystem

The payment industry is a landscape with many different entities relying on each other to operate efficiently and securely. At its core, the payments industry is a network that communicates payment information from point to point. However, they don’t all speak the same “language”, if you will, and often have unique roles – creating complexity and confusion.

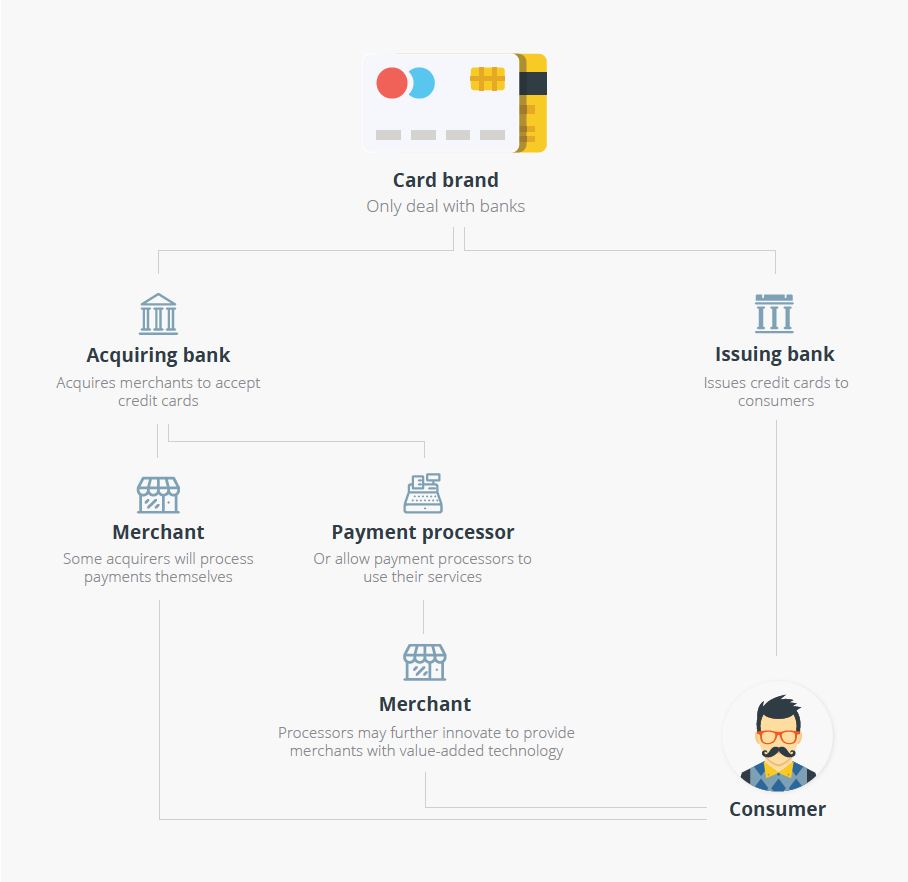

The image below depicts how the main payment entities interact with each other. Whether you’re a merchant or a consumer, the payment process will always start with card brands. Think of them as “wholesalers” who only talk to banks (issuers and acquirers). The card brands allow the issuer to issue co-branded credit cards to consumers, and the acquirers to acquire merchants who accept credit cards. Some acquirers process payments themselves, while other acquirers allow third-parties (payment processors) to use their services as well as further innovate payment technology to bring more value to merchants.

Payments landscape

From eCommerce gateways to mobile payment providers to turnkey processors, there’s been an influx of companies entering the industry over the last few years, which means the payments landscape has expanded significantly. The number of Fintech (financial technology) companies grew from 1,000 in 2005, to over 8,000 this year. This bodes well for merchants as there’s a wider variety of selling methods and innovative technology available. But with growth comes confusion.

To give you an idea of what that looks like, we’ve created a snapshot of the payments landscape in North America. We’ve organized the companies into 17 different categories:

| 1. Card Brands | 10. Online Payment Gateways |

| 2. Acquirers | 11. eCommerce Payment Providers |

| 3. Issuers | 12. Recurring Billing Payment Providers |

| 4. Payment Processors | 13. Tablet POS Providers |

| 5. ISO (Independent Sales Organization) | 14. Terminal Hardware Providers |

| 6. Aggregators | 15. POS Terminal Companies |

| 7. Mobile Wallets | 16. POS Software |

| 8. Mobile Wallet Platforms | 17. Closed Loop Payment Networks |

| 9. Mobile Payment Providers |

It’s a broad mix of payment vendors and payment technology solutions. As you’ll see, some companies wear many hats and fall into more than one category.

To see the snapshot of the Payments Landscape and a comprehensive list of the companies in the industry, download our Finsight Payment Landscape: The Who’s Who in the Industry below.

The above is an adapted excerpt from our latest Finsight Payments Landscape: The Who’s Who of the Industry. Download your free copy on the right.