The easiest way(s) to accept payments

Credit card processing done 7 different ways

When you team up with us, great things happen.

Become a Payfirma partner

We’ve partnered with innovative software companies and progressive financial institutions alike to offer a seamless payment solution.

Everything you need to get paid, get insight, and get growing.

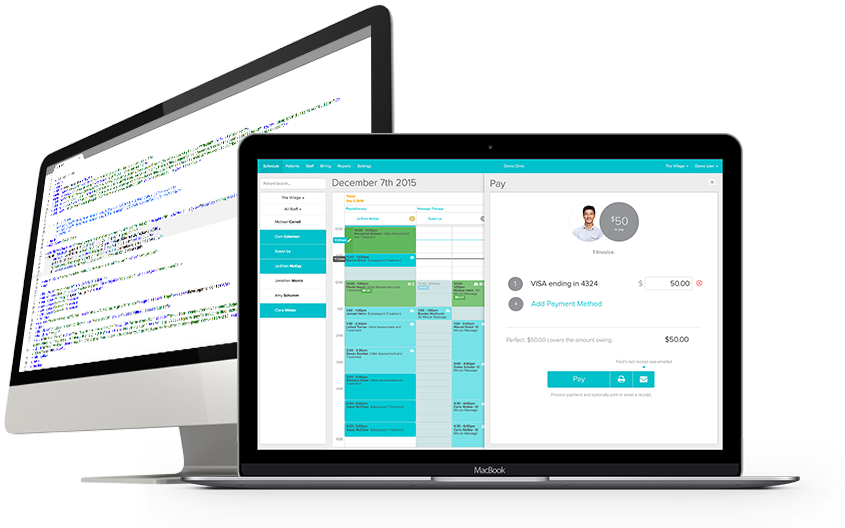

Ready to build with our API?

Visit our developer center to explore one of the most intuitive APIs on the market, FAQs, and our how-to guide.

View DeveloperHQ >Ready to accept credit cards?

Get in touch with a payment advisor for a custom quote unique to your business. Call + 1.800.747.6883

Sign up today >